Cryptocurrencies seem a world away, lost amid the lofty towers of finance in New York and London. But look closer at Africa, where ordinary people propel peer-to-peer digital assets in everyday transactions.

Far from speculative bets made by suits behind screens, individuals across Nigeria, Kenya, South Africa and beyond use stablecoins for escaping inflation or sending cross-border payments.

Unencumbered by institutional inertia, African users rapidly build this parallel financial universe brick by brick.

How do Africans navigate this new web of decentralized finance in practice?

Journey with me across borders and wallets to glimpse how and why crypto takes roots at the grassroots.

(This article is best displayed on a computer or tablet, rather than a phone, as it has many graphs and images that are much easier to read that way. You can click on any image to expand it.)

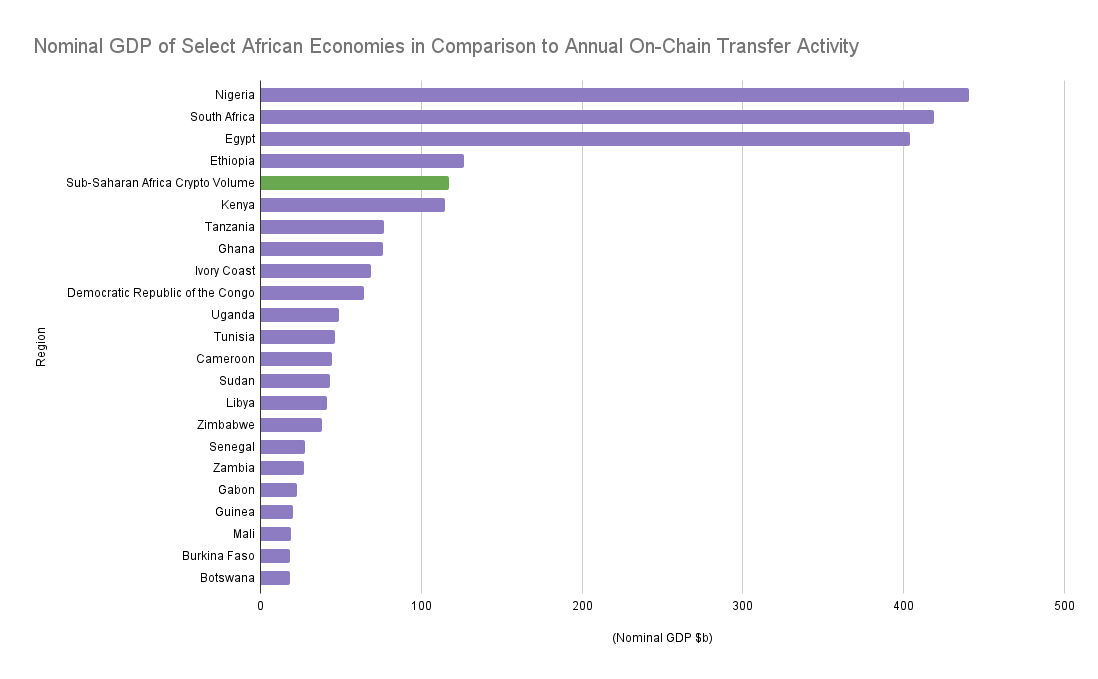

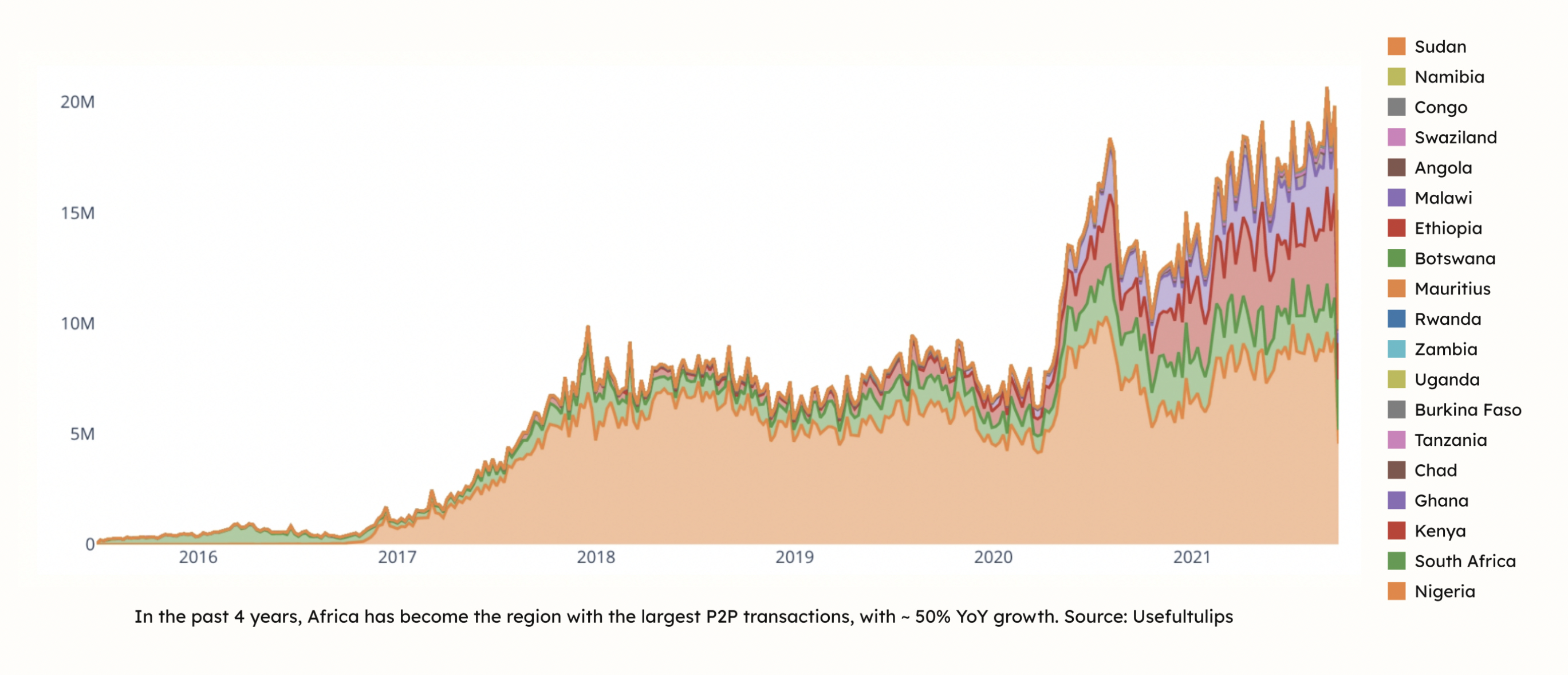

You might be surprised to learn that Sub-Saharan African countries transacted a staggering $117 billion using cryptocurrencies between July 2022 and June 2023, an increase from $100.1 billion for the same period in the previous year.

For perspective, that number dwarfs the annual GDP of leading regional economies.

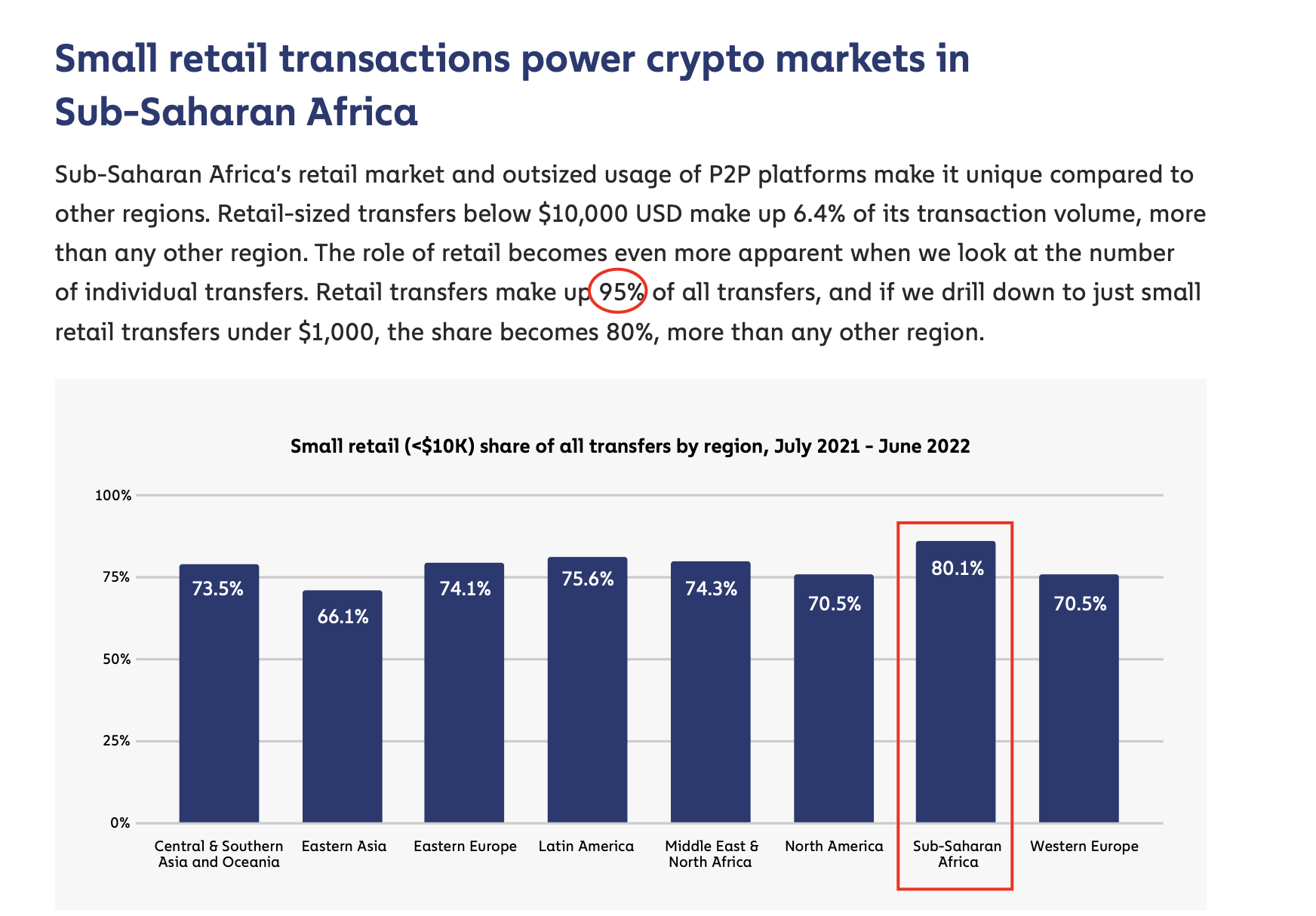

Additionally, it’s not just big businesses that are doing the transacting.

Why are many regular Africans citizens using crypto in ways that people from other parts of the world simply don’t?

At first glance, the vast majority of us do not seemingly have any special needs that would require us to understand, much less care about cryptocurrencies – after all, we’re just trying to solve 24-hour electricity first.

On the flip side of that coin (haha), some African countries are being forced to adopt cryptocurrencies at industry-leading rates because their own government-issued, fiat, currencies are not able to adequately serve their needs in specific areas.

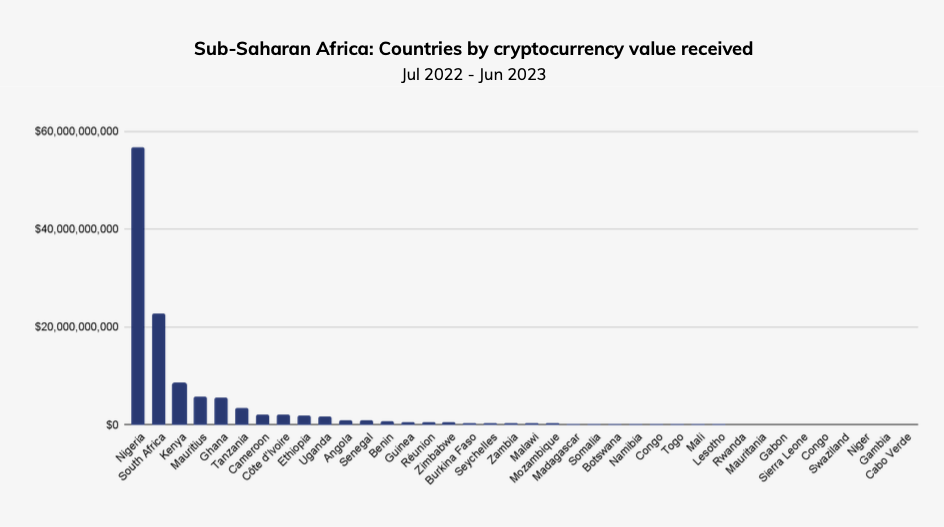

The distribution of cryptocurrency value received by country speaks to this in detail: South Africa, Nigeria and Kenya alone make up over 70% of transacted value.

Each of these big 3 nations has unique motivations for cryptocurrency adoption, but common themes connect them. For the time period above, Nigeria sees the highest crypto transaction volumes on the continent, approaching $58 billion annually.

For Nigerian institutions, virtual assets facilitate efficient cross-border settlements for international trade and operations. Meanwhile, retail users leverage cryptocurrencies for remittances abroad and as havens from Naira inflation.

By converting local currency to stable foreign alternatives, everyday Nigerians preserve purchasing power to offset rising consumer prices. Although distinct local dynamics drive crypto usage in Kenya, Ghana and elsewhere, hedging currency risk and moving money across borders represent recurring adoption catalysts across Africa.

The way that people also interact with cryptocurrency also varies greatly – and we will explore that in a bit – but first, it’s important to understand why that is the case.

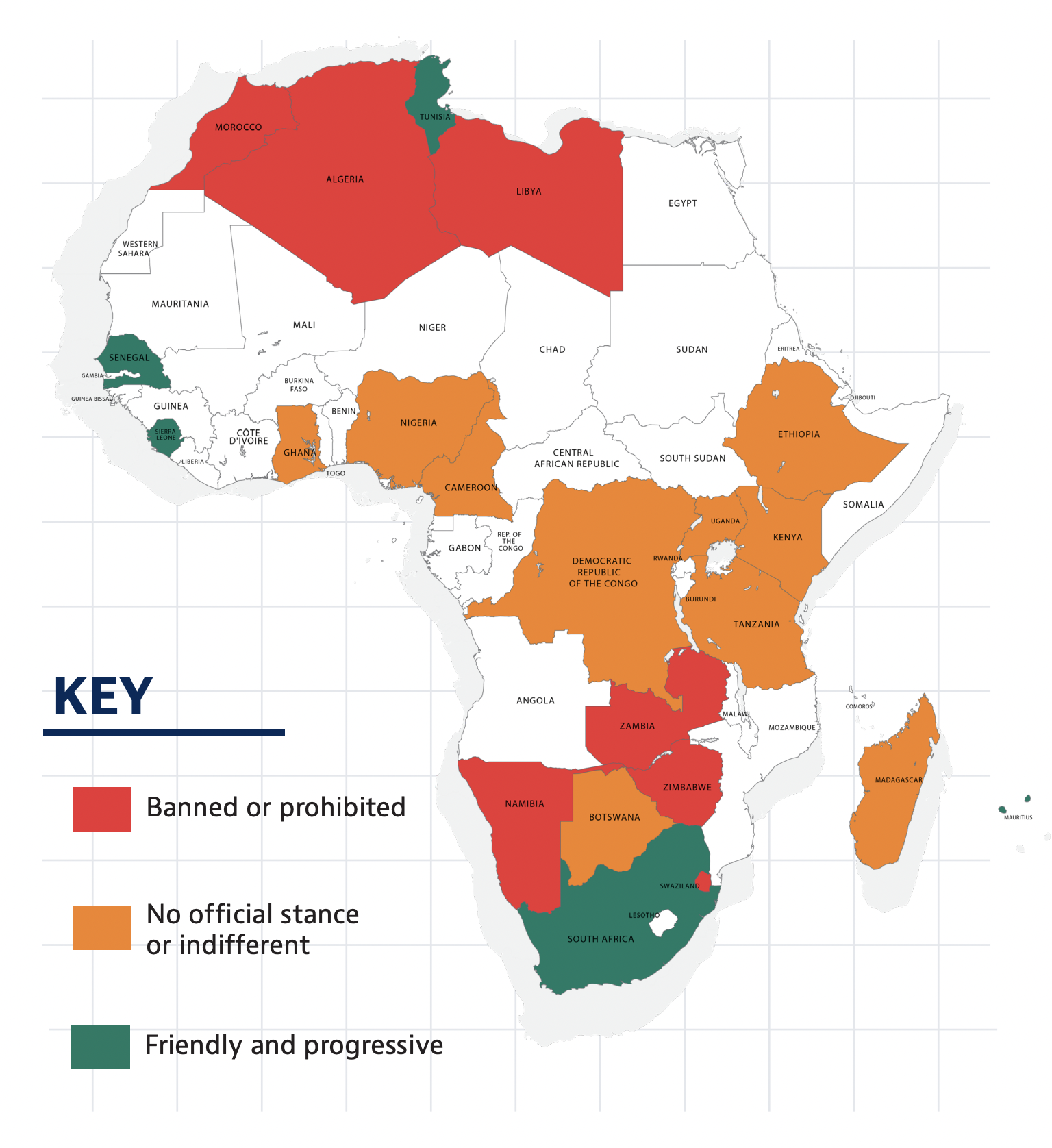

There is a lack of regulatory clarity on crypto in many African countries, with some nations opting to ban it out right.

This regulatory ambiguity makes it very difficult for professional entities that allow people to buy and sell cryptocurrency easily, known as centralised exchanges, to operate in Africa.

So instead, what happens is that people buy and sell cryptocurrency to each other. A popular way to do this on the continent is through Binance – which is at the time of writing, the largest cryptocurrency exchange in the world.

Acquiring U.S. Dollars for trade often proves burdensome even for African businesses holding ample local currency. These rigidities created a vast parallel market facilitating Dollar access in cash transactions. Unlike official fixed rates, parallel exchange rates operate on street-level supply and demand dynamics. Their emergence in multiple African countries highlights structural inefficiencies and currency access gaps.

Cryptocurrencies present a pathway to bypass these friction points. Instead of navigating opaque parallel markets, African importers use cryptocurrency’s abundant liquidity and instant settlement to pay overseas vendors directly.

The peer-to-peer nature of crypto transactions allows business owners to exchange currencies without intermediaries. This hands-on role driving global commerce explains swelling peer-to-peer crypto volumes across African trade corridors.

Adoption rises in response to acute needs unmet by legacy systems.

How P2P Crypto Works in Africa

Cryptocurrency trading in Africa deals in assets beyond Bitcoin. Understanding some core concepts provides context around user activity:

💡 Native crypto assets, like Bitcoin and Ethereum, are the original tokens of their respective blockchain networks. They are often subject to high volatility as their value is driven by supply and demand dynamics, speculative trading, and market sentiment.

💡 Stablecoins, on the other hand, are a type of cryptocurrency designed to maintain a stable value over time, typically pegged to a fiat currency like the US dollar or a basket of assets. This stability is achieved through a reserve of the underlying assets or through algorithmic mechanisms, making stablecoins a more predictable option for transactions and a hedge against the volatility of native crypto assets.

💡 Fiat money: in a broad sense, all kinds of money that are made legal tender by a government decree or fiat, such as bank notes of a specific currency.

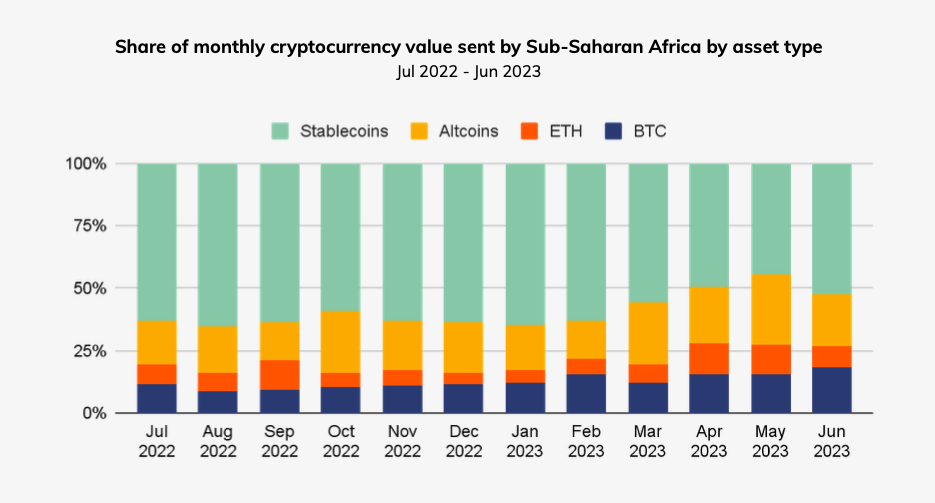

The majority of crypto transactions in Africa are through stablecoins, suggesting that transactors are typically looking either to make payments or hedge against local inflation rather than speculate on the value of native assets.

So how does one go about transacting stablecoins?

Let’s do a walkthrough of common experiences across major markets.

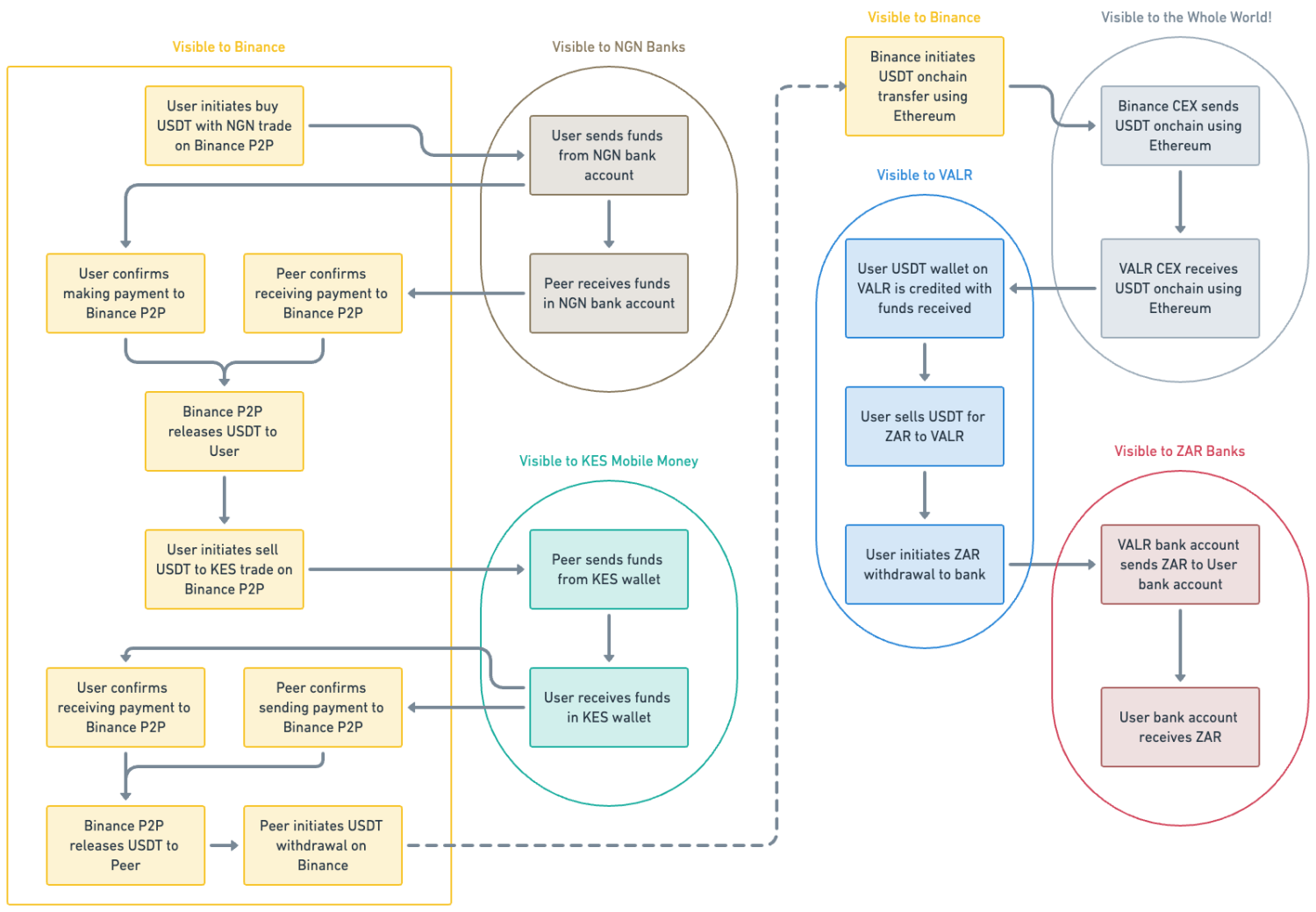

First, we’re going to use some Naira to buy $100 worth of stablecoin from Binance P2P that we’re going to transfer $40 to Kenya and sell for Shillings, and also transfer $60 to South Africa and sell for Rand.

We’re going to do all of this in 30 minutes using different exchanges and payment methods.

Binance offers a P2P exchange service – platform that lets users match with counterparties who are on the opposite end of their desired trade. If you have local currency and are looking to buy stablecoin, Binance will match you with someone selling stablecoin for local currency. Most times, this will be your first and only interaction with this counterparty, who is another person that you otherwise would not know in any capacity.

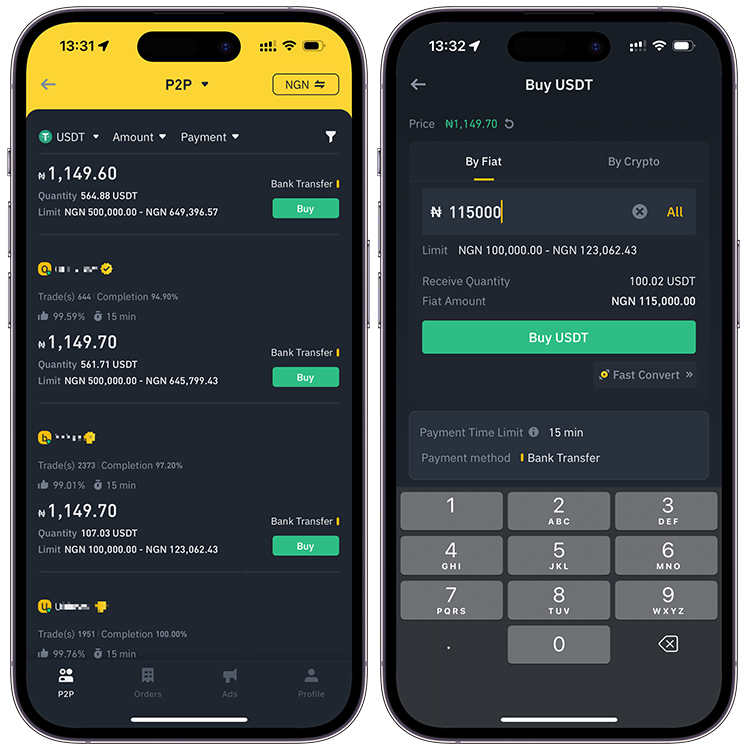

NGN to USD

The process starts with finding an ad for the amount we are looking to buy or sell – in this case we are buying. We get different exchange rates depending on the amount we’re looking for and the payment method we want to use. While in most countries, the exchange rate is lower if we want to buy more volume, in Nigeria, the exchange rate tends to be higher for larger volumes.

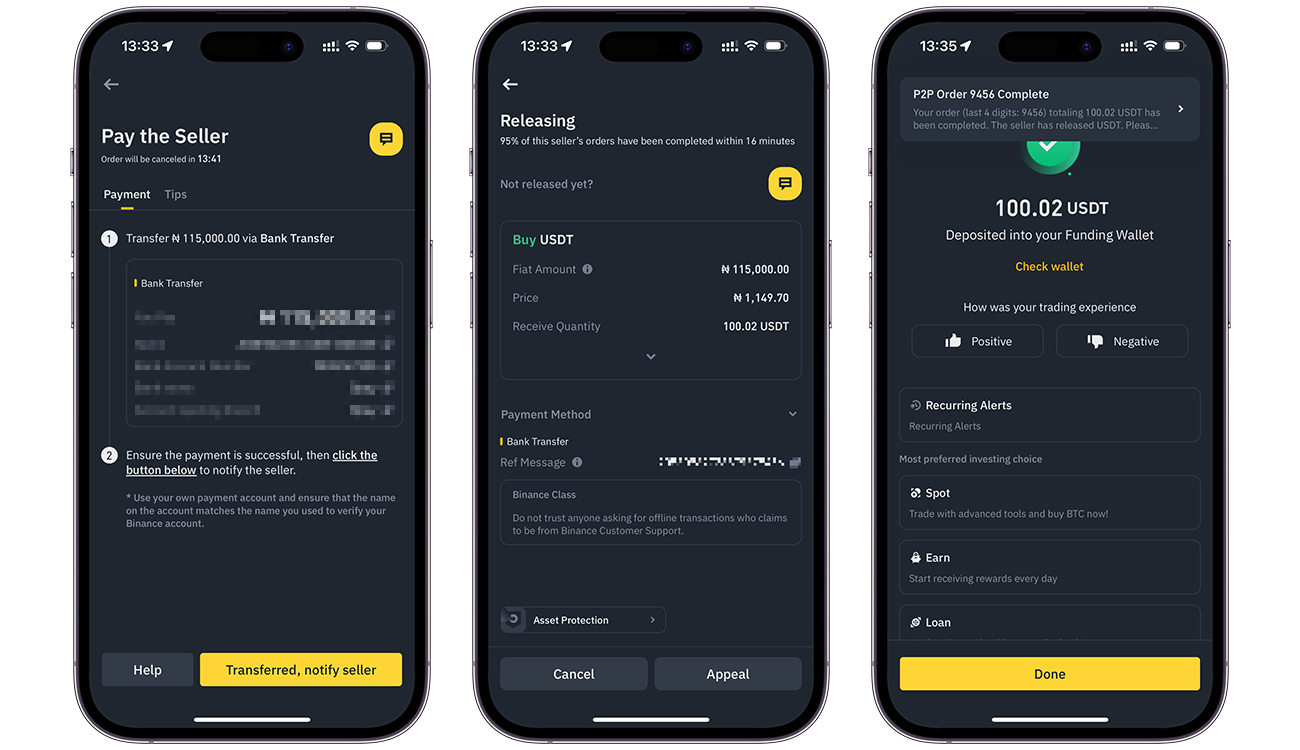

In the first screen above, we see different ads from different P2P traders specifying their rate and the amounts we have to be trading to access them.

On the right hand side above the “Buy” button, we see the supported method. In the second screen above, we specify the amount of local fiat currency we want to spend and the amount of USD stablecoin we will receive is shown in the “Receive Quantity”.

Binance P2P holds the funds from the counterparty in escrow until both sides confirm the fiat currency side of the transaction.

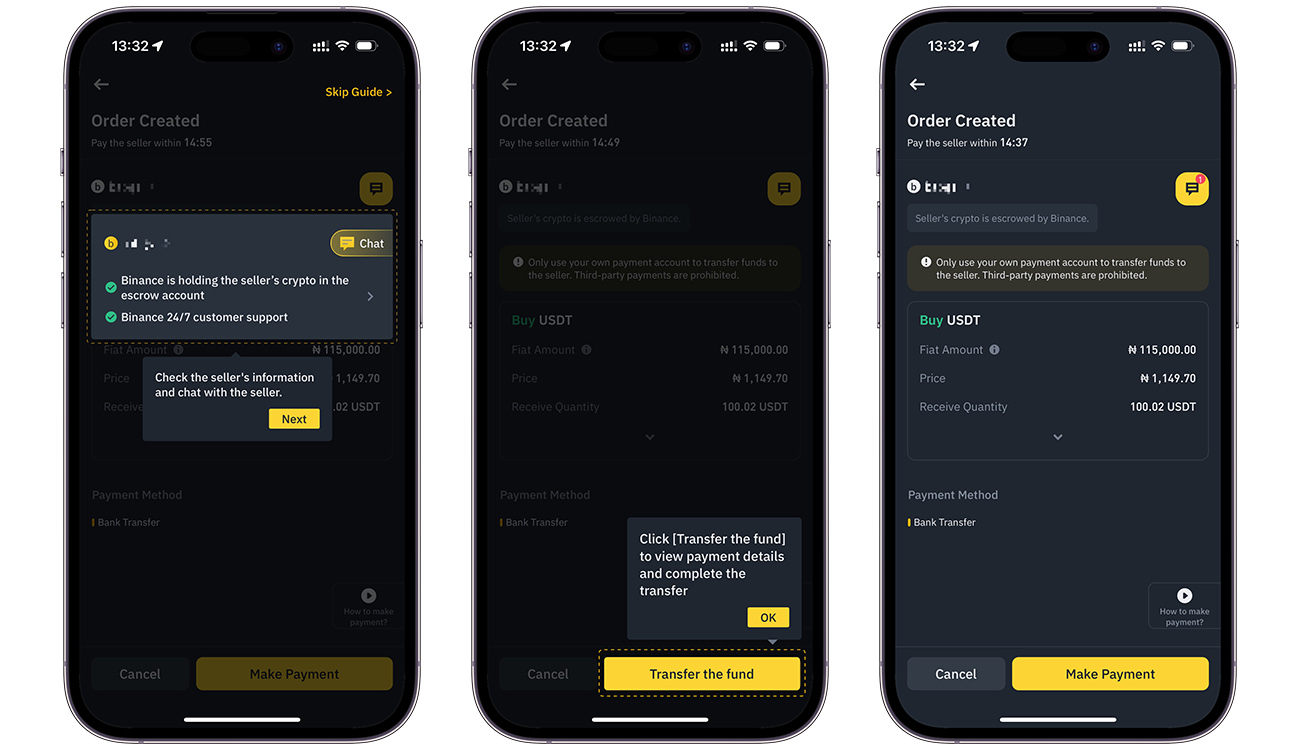

The screens above show the walkthrough of instructions to follow. You basically confirm the amounts for the trade and tap “Make Payment”.

In the screens below, we are presented with the name and bank details of the peer who is selling us the USD stablecoin. This includes their government name which we are supposed to crosscheck against the name on their bank account.

We’re only supposed to transact if they match, but in practice most people don’t do this. In this case, the names do match and we proceed to complete the transfer.

There is a time limit in which we have to complete the bank transfer to the peer, otherwise the Binance P2P transaction will automatically cancel. In this case, the time limit is 15 minutes, so we quickly hop into our bank app to initiate the payment. Thankfully, bank transfers in Nigeria are instantly settling thanks to NIBSS, so this will be a breeze.

We now head back into the Binance app to let Binance P2P know that we have completed our side of the transaction. The seller also has a time limit – in this case, 16 minutes – to release the funds to us. If they don’t, we can appeal and someone from the Binance Support Team will join the conversation and assess evidence to make a decision.

We’re dealing with a highly rated seller, who has a reputation for releasing funds quickly, and within 2 minutes they verify receiving the funds from the bank transfer and release the USD stablecoin.

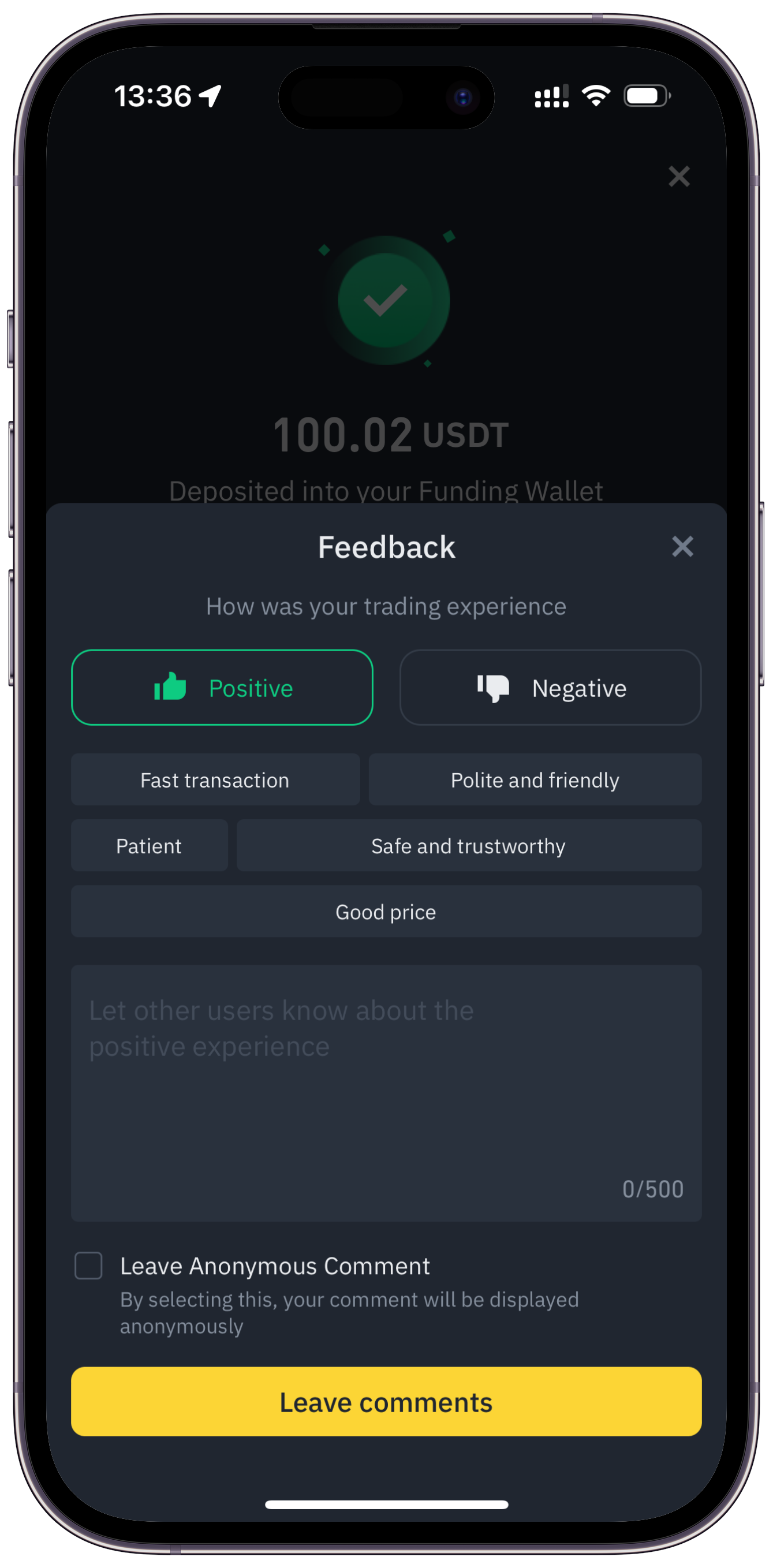

After the transaction, we are given the opportunity to rate the counterparty for the trade.

Generally, this rating system is what prevents scams and bad actors operating on the platform. If you get too much negative feedback, Binance P2P will suspend your account. Also, the entire process took 6 minutes from end to end, as you can see from the clock time in the screenshots.

USD to KES

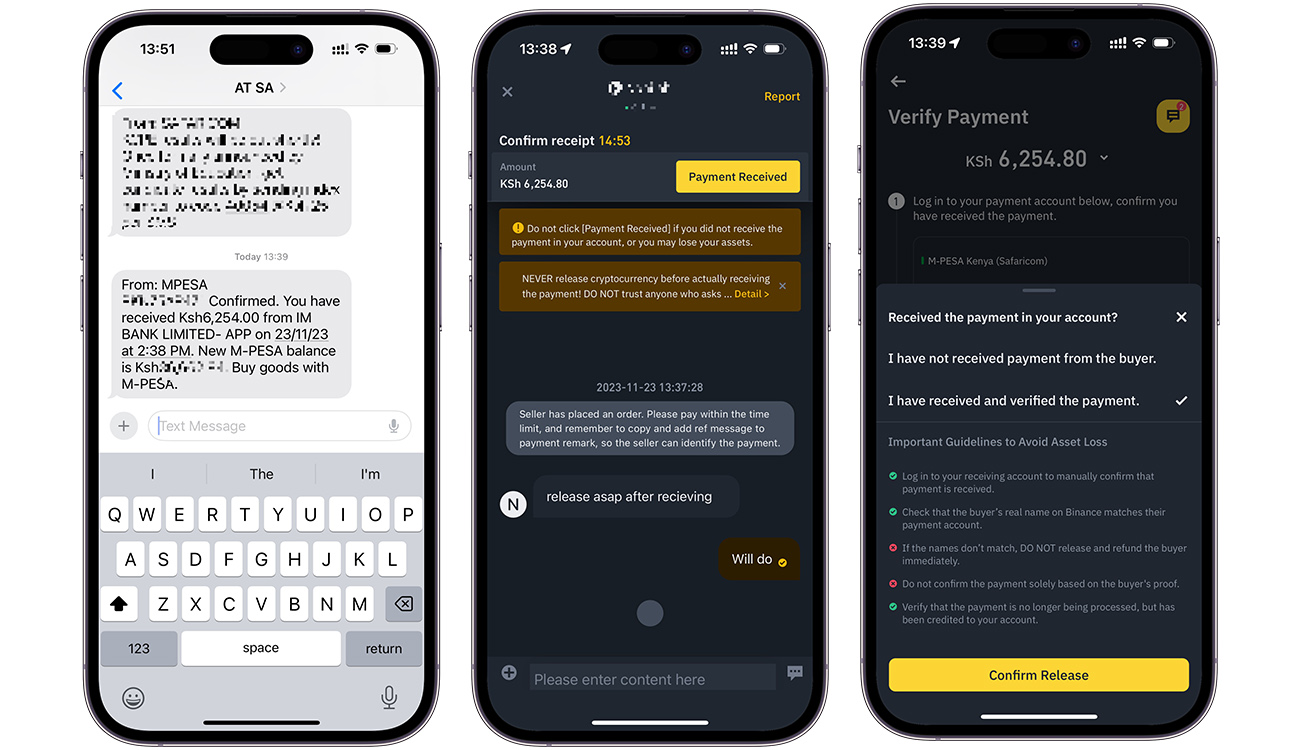

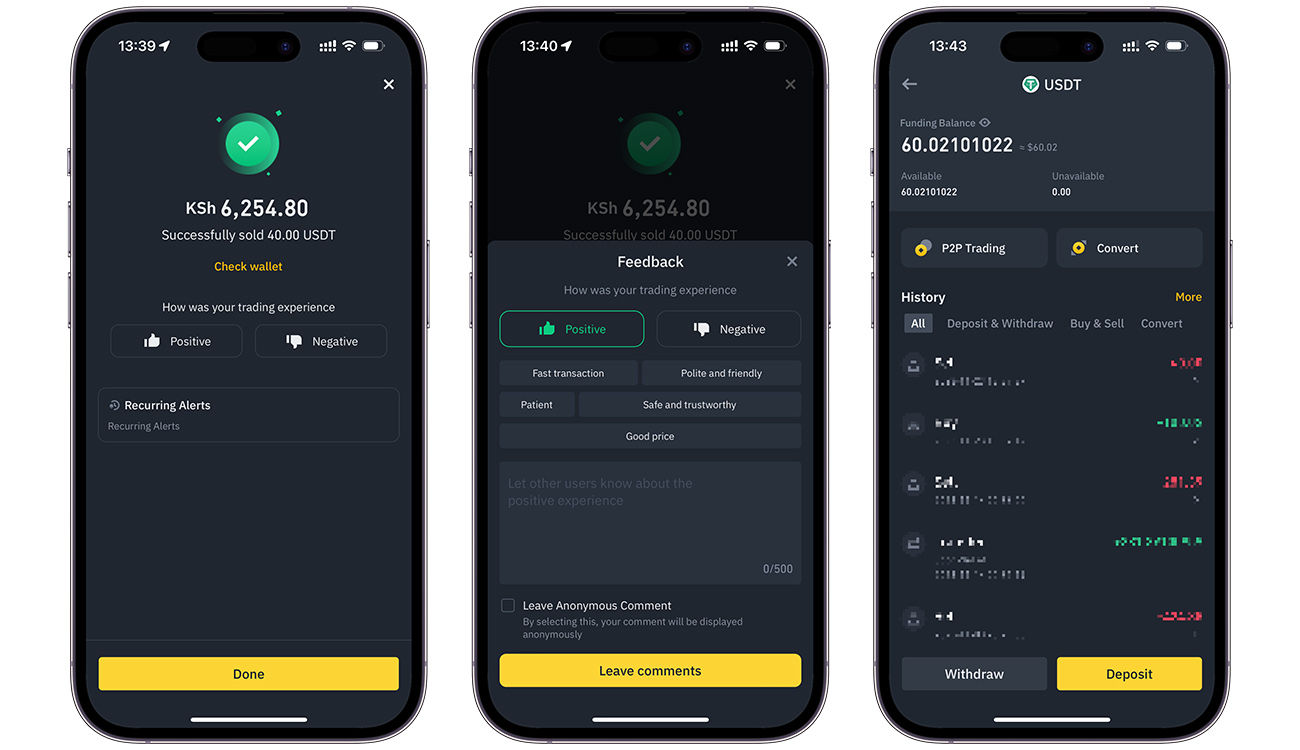

Now that we have the USD stablecoin in our Binance wallet, we’re going to proceed to sell $40 of it for KES in Kenya, aiming to receive the funds via M-PESA.

This time we’re the seller, so we go through the same process we used earlier to find a rate on the sell side. We find one and get matched to a counterparty in Kenya looking to buy USD for KES. Once we start the trade, we wait for the counterparty to send us M-PESA to our specified mobile number. We also have a chat window to be able to communicate with them directly.

The buyer has 15 minutes to make the payment to us and confirm that they have done the same to Binance P2P.

Within 2 minutes of opening the trade, they have done so and we see the M-PESA confirmation message.

(The format is different from a regular M-PESA message because the SIM card is in a different Android phone, which uses SMS Forwarder and a simple script I wrote with ChatGPT to forward all messages I get on my Kenyan line to my South African line over the Internet using Africa's Talking APIs.)

With that, we can release the funds and complete the rating process.

Keep in mind that it took us 10 minutes to transfer NGN to USD to KES using Binance P2P, much faster than would have been the case on any other traditional rail.

USD to ZAR

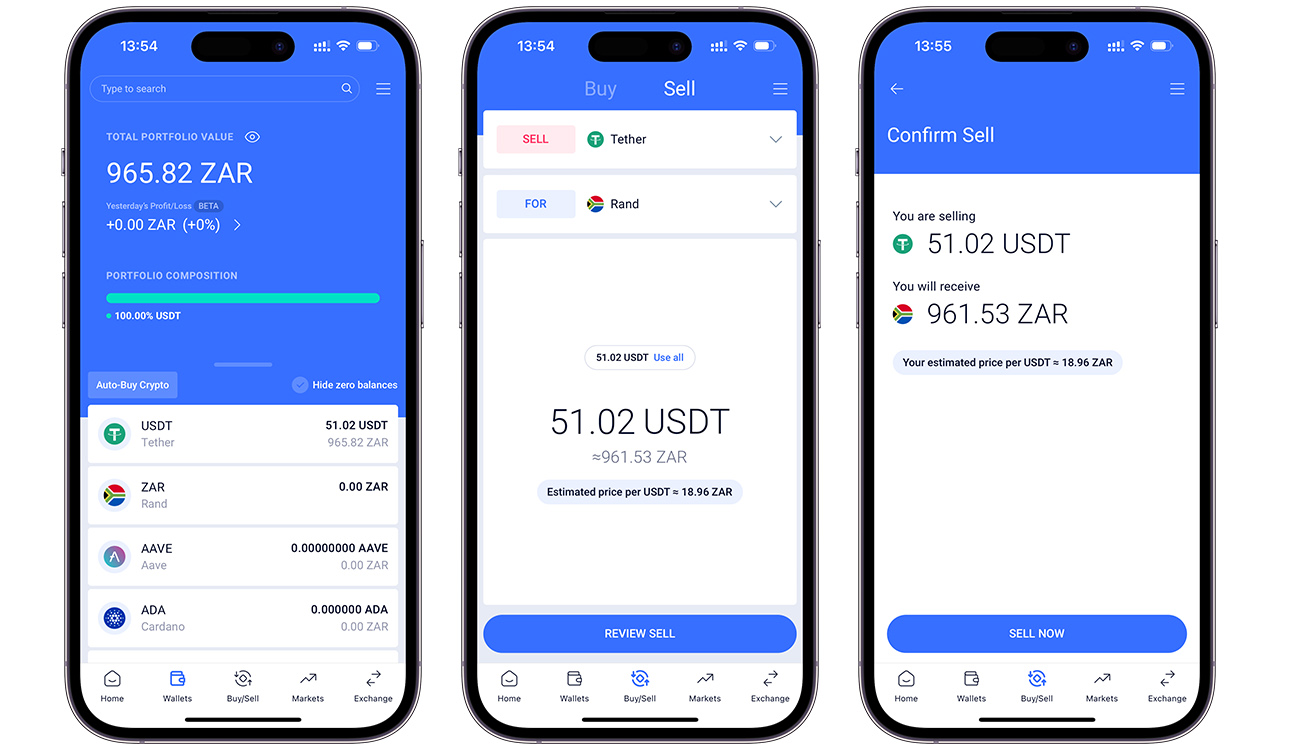

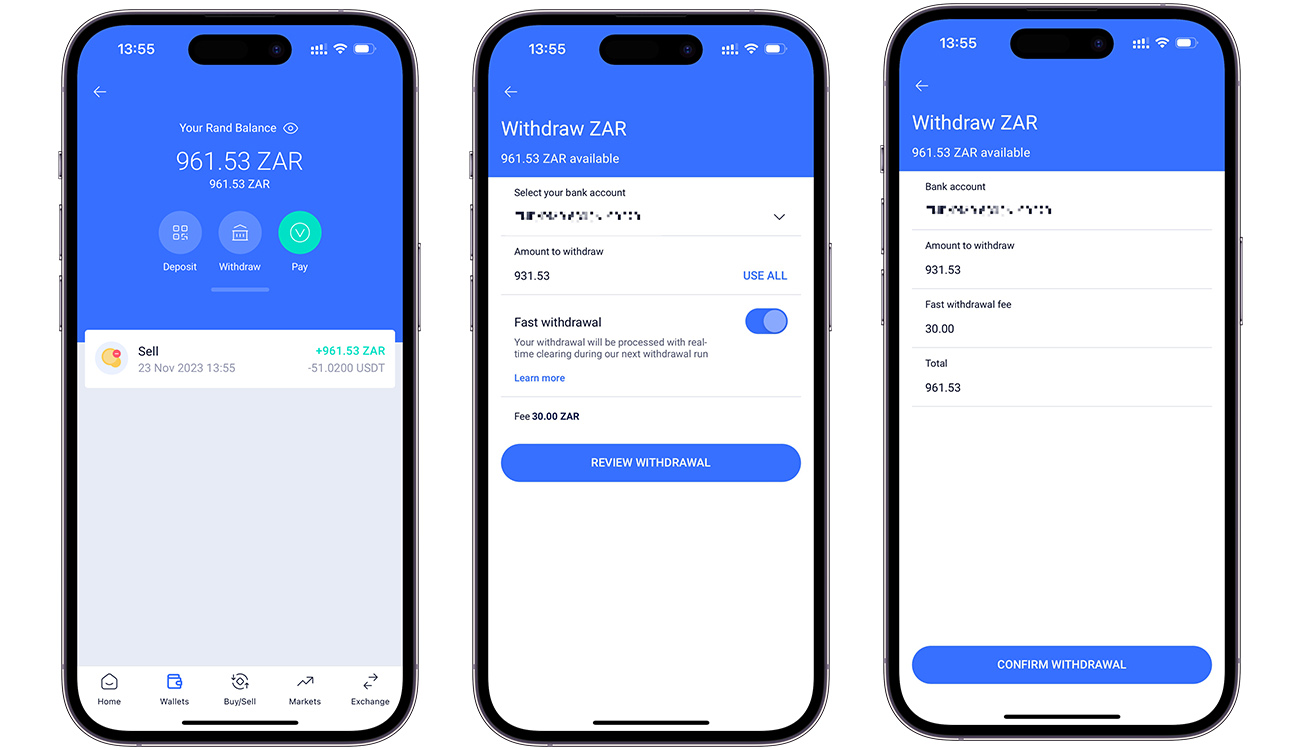

Now, with the remaining $60 we have in our Binance exchange wallet, we’re going to sell that for ZAR in South Africa using VALR – one of the largest centralised exchanges in the country.

We can do this in South Africa because the industry is regulated, with clear licensing frameworks for cryptocurrencies and other types of virtual assets.

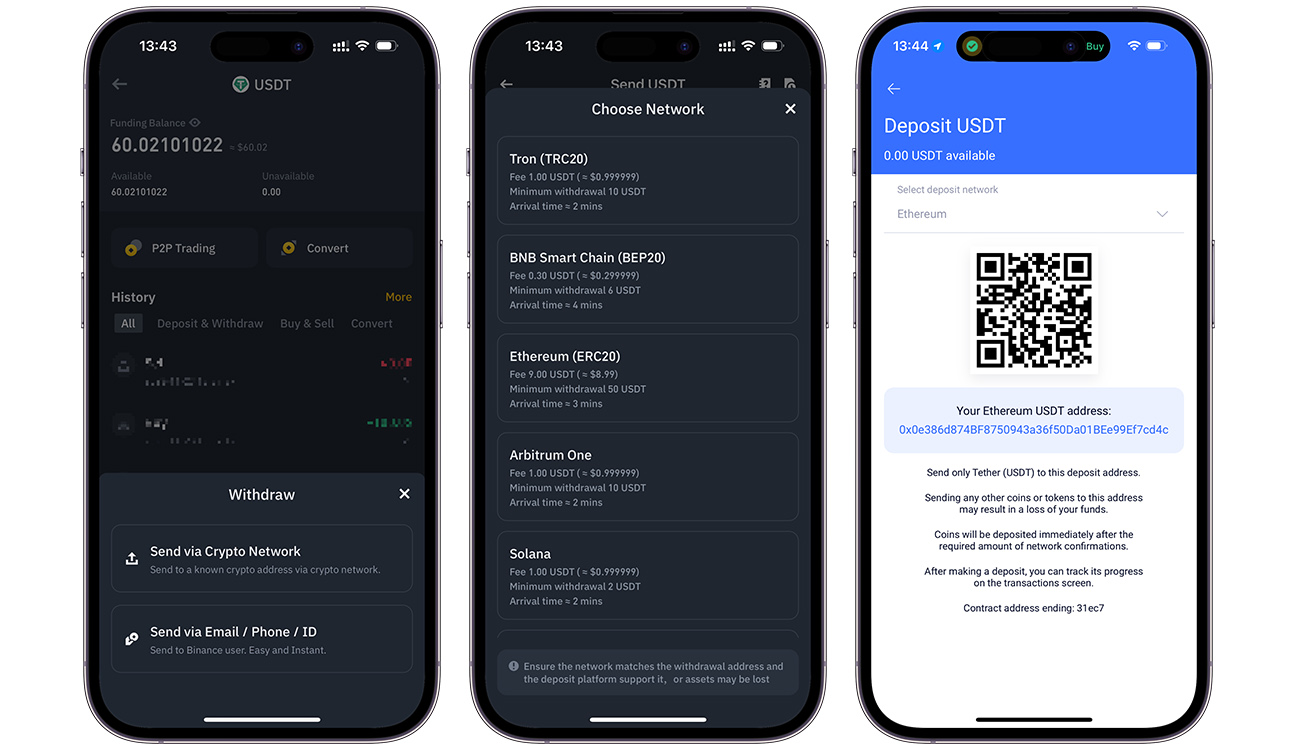

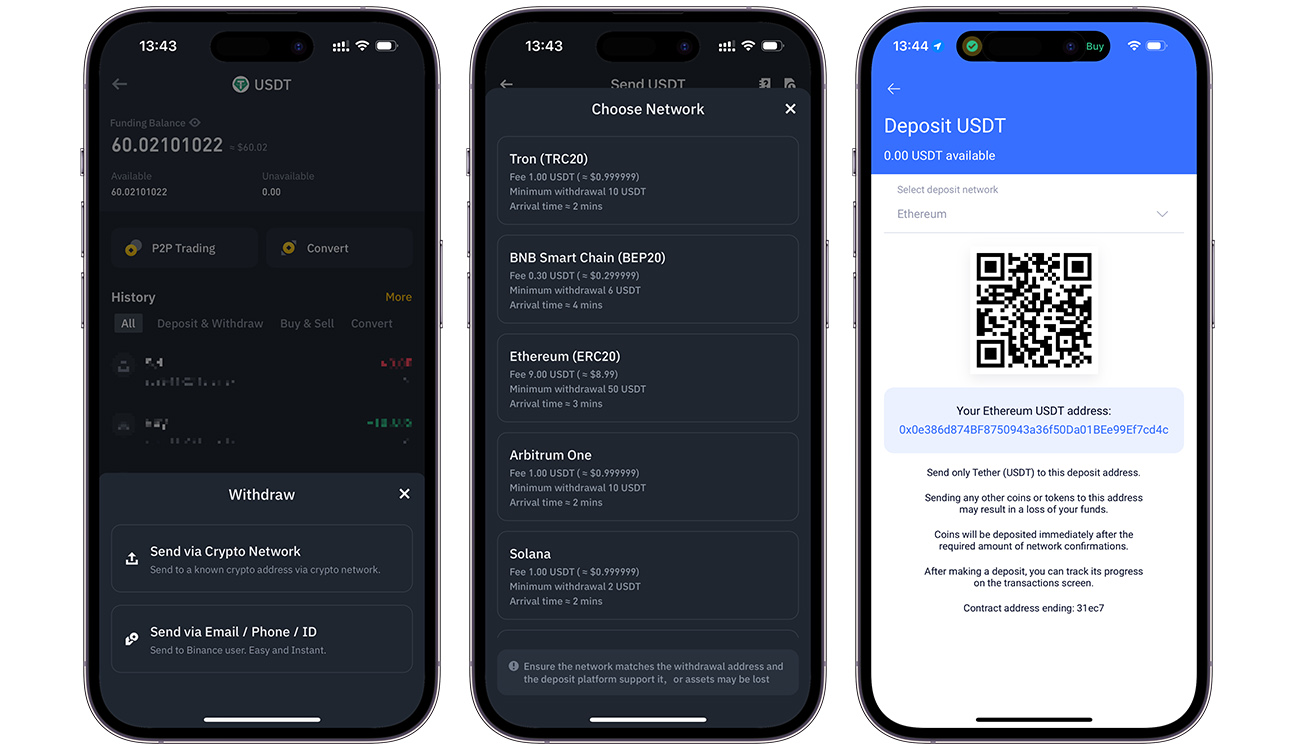

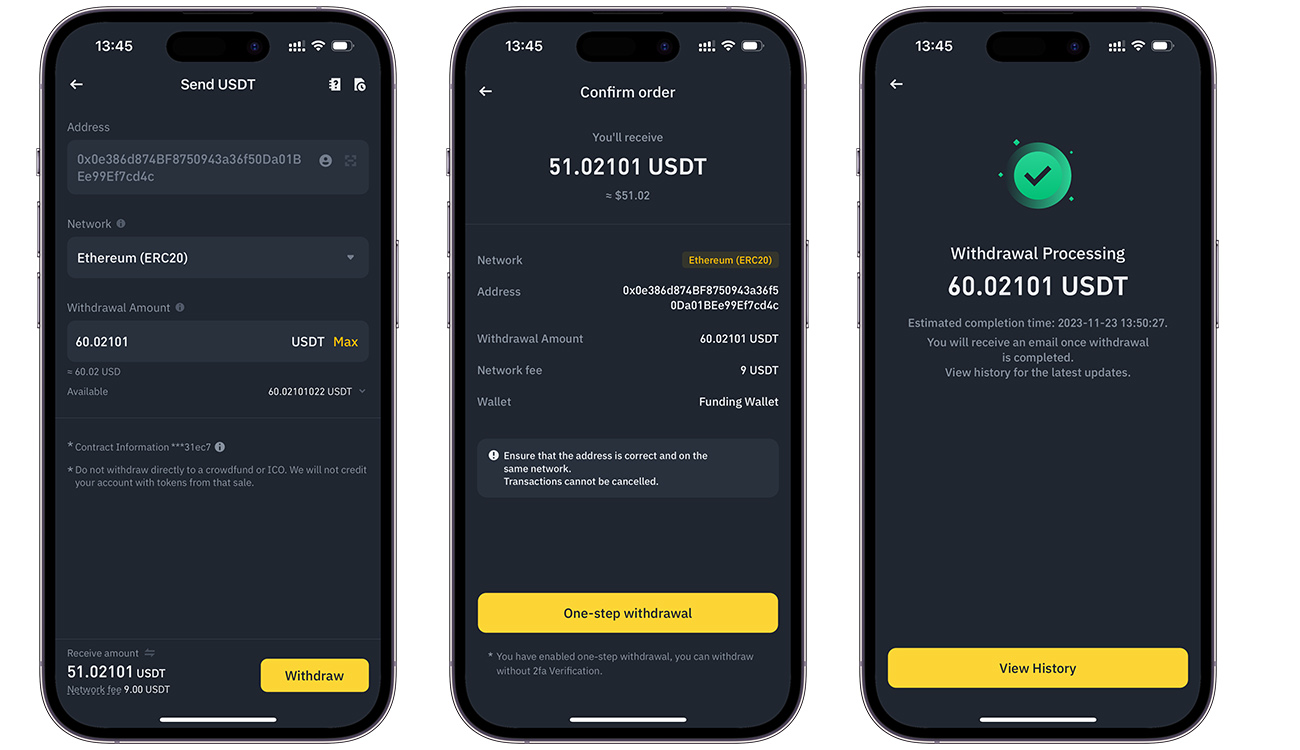

In the Binance app, we will select the withdrawal option for the USD asset we have.

For the transactions we did above, we used USDT as our stablecoin.

There are different US Dollar stablecoins such as USDC, PyUSD, cUSD, DAI and many others. In theory, they are all supposed to be worth 1:1 to regular US Dollars, but there are many factors that determine the “quality” of a stablecoin and how it gets used. You can learn more about that here.

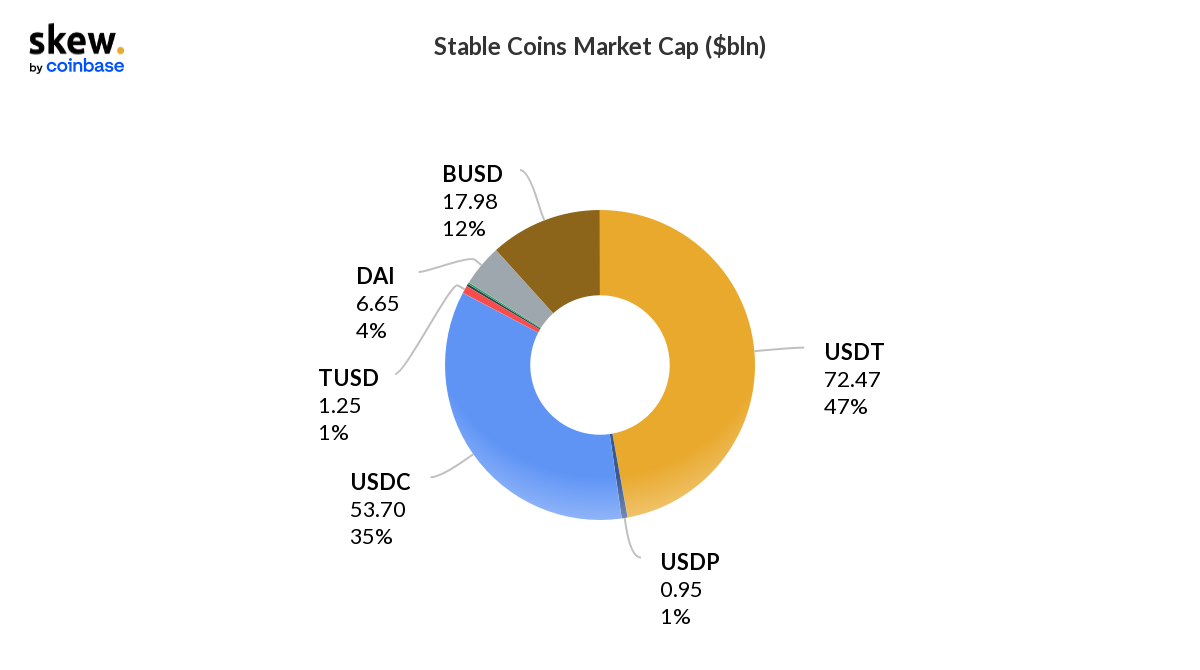

The two most relevant stablecoins (around the time of this writing), are USDT and USDC as they have the highest utilisation.

My personal view is that USDC (USD Coin) is often considered a safer stablecoin option compared to USDT (Tether) for a couple of reasons:

- Transparency and Regulation: USDC is issued by Circle, a company that is known for its transparent operations and compliance with U.S. regulations. They provide regular attestations by independent accounting firms, verifying that each USDC is backed by one U.S. dollar held in reserve.

- Backing and Trust: Tether’s USDT has faced scrutiny regarding its reserves and the exact nature of the assets backing it. Past controversies have raised concerns about whether all USDT tokens were fully backed by U.S. Dollars.

Yet Tether’s USDT persists as the dominant stablecoin by transaction activity despite concerns over reserves and opacity.

What perpetuates its lead? Primarily network effects and flexibility. USDT enjoys first-mover advantage, gaining integration across far more exchanges and blockchain networks enabling usage everywhere from trading to remittances.

Furthermore, with support for a wide range of chains, USDT can transfer on both advanced networks like Ethereum or cheaper blockchains including Tron and Solana that sacrifice aspects of decentralization and security for improved transaction speeds and reduced fees.

There are many different places online where you can learn more the technical definition of a what a blockchain is and how it works, but I’ll try to simplify the differences between chains with a basic example.

Suppose you’re in Johannesburg and trying to get to Cape Town by air. You have multiple options such as South African Airways who offer a separate business class cabin and full meal service on board at a premium, but you also have options like FlySafair which are much lower cost but come with no frills. You will still get to Cape Town at the end of the day, but with varying levels of comfort.

With blockchains, the same analogy applies but the trade-off is between cost and security, rather than cost and comfort.

Singapore Airlines also flies a domestic JNB to CPT route, but only for onward travellers to Singapore ☹️

What “security” truly means in the context of blockchains is beyond the scope of this piece and the curious among you can learn more here.

Now, back to our money movement flows.

We select the “Withdraw” option in Binance and choose to send the funds onchain, i.e. using a blockchain for the transaction.

We are presented with multiple options for blockchains where we can move our USDT from Binance to VALR. Tron is one of the most popular chains used in Africa because it has deep liquidity in different countries, fast transactions and low cost.

However, we’re going to use Ethereum as that’s the only blockchain VALR supports for USDT.

Around the time of this writing, Ethereum is generally considered the gold standard in blockchain security due to it’s relatively decentralised nature and wide adoption globally. It was also the first blockchain to widely introduce smart contracts, which are the computer programs that run on blockchains to make transfers like these possible.

The cost of a transactions on a blockchain is usually a function of how much computing power is required to execute the transaction on that blockchain. The computing power used maps directly to the cost of electricity to run the computers, which is why you might see complaints about Bitcoin’s environmental impact – it uses a notorious amount of energy to verify even the simplest of transactions.

In the screens above, we see how our transaction has been sent on the blockchain, so we exit the Binance app and open the VALR app after about 10 minutes.

We immediately see our balance from the USDT on Ethereum blockchain we just received.

Unlike the previous two scenarios where we had to find a match with a counterparty for the trade, VALR is a centralised exchange so we can appear to sell our USDT directly to them for ZAR. The process is much simpler with 3 quick taps.

In the background, we actually sell the USDT on the VALR platform to another market participant who was looking to buy (VALR’s technology matches the orders). The other party who was looking to buy now has the USDT and we have their ZAR.

VALR’s technology can also match multiple orders at the same time, so if someone does a big buy or a big sell (taker order) that might match with several other orders and different traders, but all of this is abstracted from the user experience.

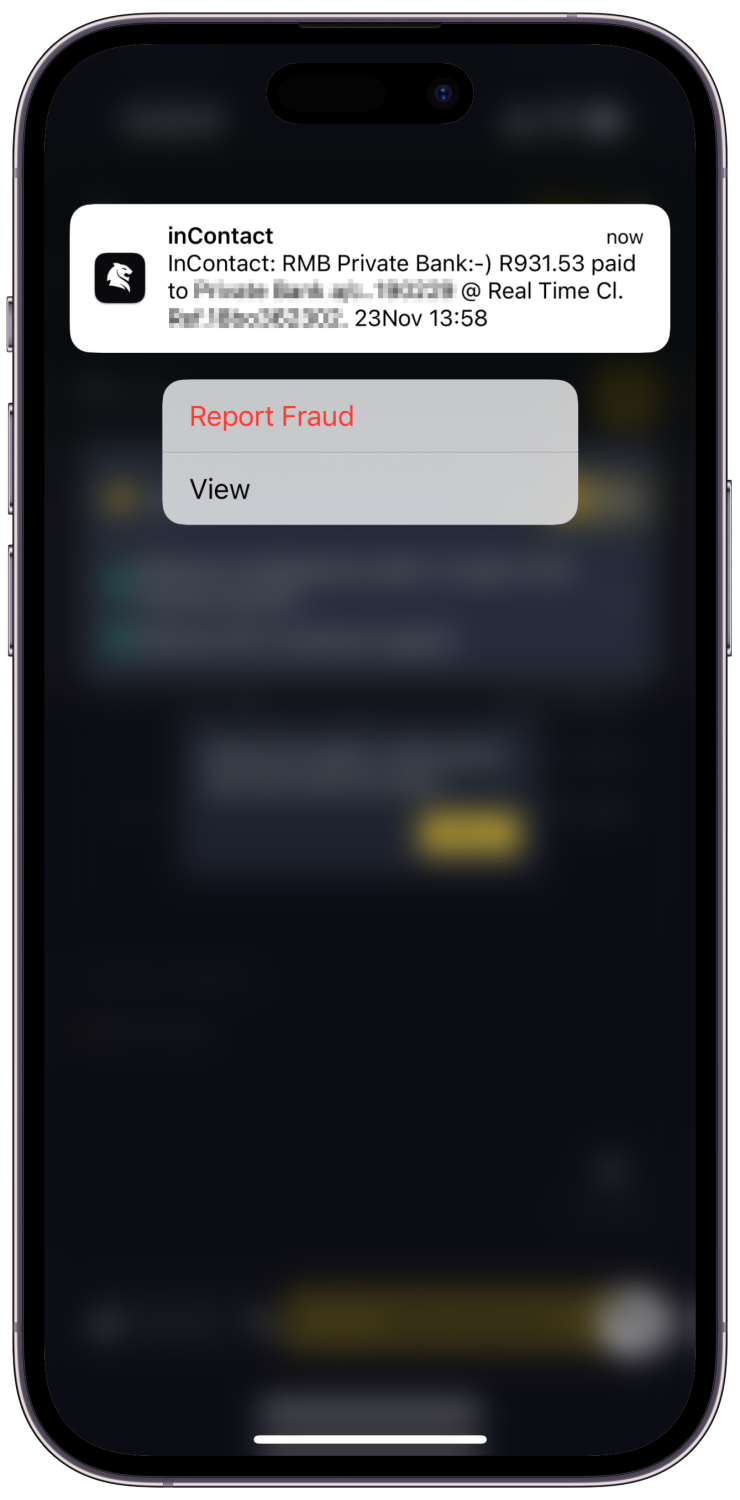

Once that is done, we can then withdraw the ZAR we just earned. Again, because this is a centralised exchange, VALR will actually transfer the funds from their ZAR bank account to ours.

And 3 minutes later…

We have the ZAR in our bank account.

Before we proceed, you might be wondering how the ecosystem players make money in these transactions. Here’s how:

- The USD stablecoin seller we bought from applies a spread to the NGN rate that they used to buy the USD.

- The KES buyer we sold to will likely resell our USD stablecoin at a higher rate than we sold it to them.

- Binance takes a small % fee of the USD stablecoin side of the transaction, as that’s the only portion of the transaction in which they have visibility and custody of assets.

- VALR charges us a small % fee for selling our USD stablecoin to them.

At scale, these transaction fees can add up to millions of Dollars for an exchange in any one country, and billions of Dollars for large global exchanges like Binance.

A P2P trader’s income will vary wildly by their trading strategies and access to liquidity, but some do it as a full time job. Others are employed as full time P2P traders drawing from a shared liquidity pool funded by a third party.

Making Sense of Cents

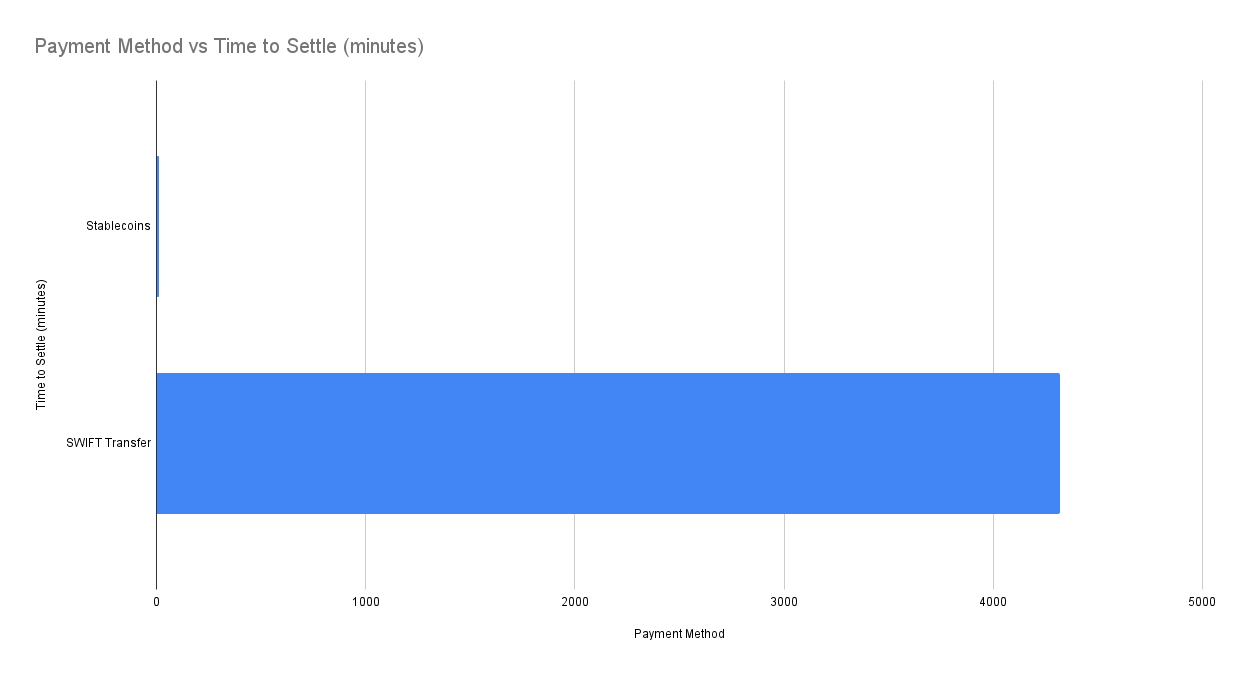

To summarise, we just transferred NGN to USD to KES and ZAR in less than 30 minutes using stablecoins.

The speed and convenience is unmatched, but at what cost?

| USD Value | LCY Value | Our Exchange Rate | “Google” Exchange Rate |

| $40.00 | Ksh6,254.00 | 156.35 | 152.85 |

| $51.02 | R961.53 | 18.85 | 18.82 |

It’s quite clear from the math above that by selling our stablecoins for local currency, we got a better rate than we would have using the mid-market rate as referenced from a Google Search at the time of the transaction.

💡 Mid-market rate: sometimes called the interbank or middle rate, is the midpoint between the buy and sell prices of any two currencies at any time.

On the other hand though, we paid 1,149.70 NGN for each dollar stablecoin when we were buying, which I’m not sure is a good or bad deal because Nigeria’s dollar economy operates on a parallel market rate without a neutral market reference point.

Using stablecoin rails was also significantly cheaper for us than using international SWIFT transfer rails.

| USD Value | LCY Value | “Google” Exchange Rate |

| $40 – $15 = $25 | Ksh3,823.75 | 152.95 |

| $60 – $15 = $45 | R845.51 | 18.79 |

Though, if we were buying the USDT with USD, we definitely would not have gotten a 1:1 rate, as exchanges have to make money on these transactions so they sell their stablecoin at around $1.001 per USDT.

Generally, the math tends to work out that you will have to pay more local currency to get USD in stablecoin rather than regular fiat currency, but you can also sell it for more. The rule of thumb is that stablecoins trade at a slight premium to regular US Dollars. Most people don’t mind, because of the obvious speed and convenience.

Compliance Complications

The convenience of crypto stablecoins poses regulatory challenges. They provide speed and efficiency for cross-border transactions, but strain legacy frameworks for visibility and control centred on traditional finance.

A few key definitions are helpful for framing stablecoin compliance issues:

💡 Compliance involves financial institutions adhering to laws and guidelines to mitigate legal or financial risks.

💡AML guidelines aim to prevent money laundering by identifying and reporting suspicious funding flows related to illegal activities.

💡 CTF regulations focus specifically on detecting and disrupting financing tied to terrorist organizations and operations.

Financial institutions have compliance organisations. Their job is to ensure that the institution operates within the regulatory framework of its respective jurisdiction.

All players in global finance commit resources towards compliance, AML and CTF to uphold integrity and stability. But stablecoins test these systems.

The transaction flow we executed using Binance P2P and other crypto networks exhibits broken visibility across rail fragments. No single institution has oversight over the entire sequence of trades from Naira into Rand, yet coherent visibility enables proper compliance procedures and controls by financial institutions.

Legacy frameworks centred on banks holding unilateral transaction oversight now appear outdated.

Before the advent of stablecoins, it was much easier for regulators to define frameworks that govern global payments, as the only way to move money around was with a handful of banks and other financial institutions.

Given this historical context, critics of blockchain technology often cite that cryptocurrency payments could be used for illegal activity, but it’s been proven time and again that trying to do something fishy on a system that leaves a permanent, immutable paper trail is a terrible idea.

In our payment journey earlier, we used the Ethereum blockchain to transfer USDT from Binance to VALR and you can see that specific transaction on the Ethereum blockchain right here.

The parts of these payments recorded on public blockchains offer complete transparency, as the immutable ledger allows anyone to view the flow of assets. The crux of the matter lies with connecting on- and off-chain segments to construct unified visibility without compromising user privacy.

Money has evolved beyond banking, and figuring out how to regulate how all these different systems talk to each other to create visibility is one of the most challenging problems and potentially lucrative opportunities of our lifetime.

One day when I recover from the trauma of entrepreneurship, I might build a business around this. I'm not quite sure if, or when - but at least I bought the domain 😅

Apart from these complications, stablecoins also effectively bypass foreign exchange controls that exist in many African countries. This creates an interesting dilemma for central bankers, as in order to regulate stablecoins as money, they first have to acknowledge that stablecoins are money.

This could have some interesting implications.

Crypto Tests the Mettle of Monetary Policy

Exchange controls in African countries serve as a financial bulwark, a set of regulations unfurled by governments to steady the currency’s exchange rate against the might of the US Dollar.

They’re like the financial equivalent of a dam, erected to regulate the flow of currency and protect against the turbulent waters of international economic currents. By keeping a tight rein on the exchange rate through these controls, the countries aim to maintain economic stability, ensuring that the local currency doesn’t buckle under the weight of sudden capital flight or the whims of fickle foreign investment.

Acknowledging stablecoins as official monetary instruments could unravel the very seams of exchange control efforts, spurring a domino effect of rapid currency devaluation due to the pent-up dollar demand. It’s like opening the floodgates when the reservoir is already brimming, risking a deluge of runaway inflation that could sweep away the public’s purchasing power, leaving the ruling government’s popularity in tatters.

In my view, this fear of economic upheaval is precisely why an African government might lean more towards outright banning cryptocurrencies – they represent a beacon of innovation and a potential maelstrom of economic disruption at the same time.

Seeing Red

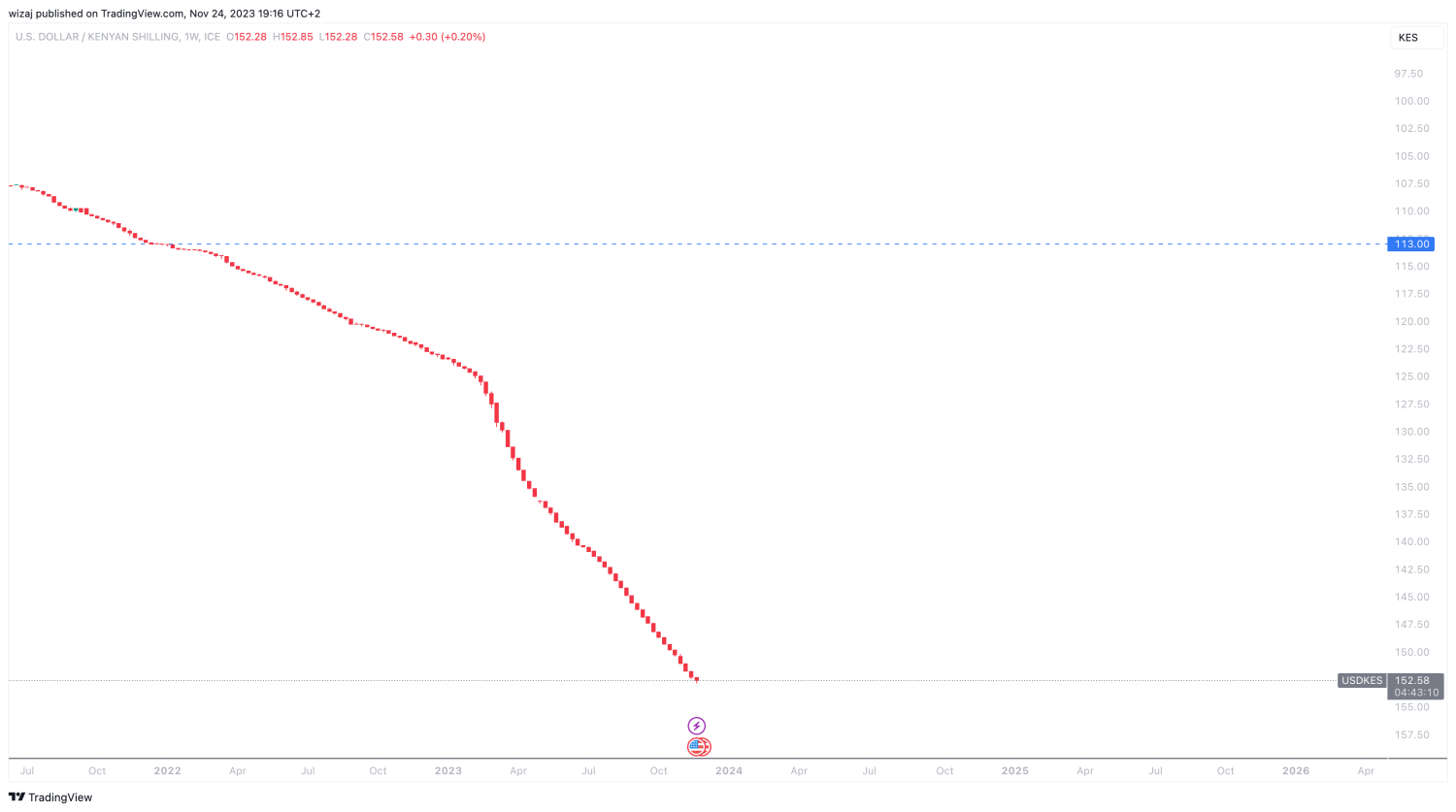

Kenya is one of the few major markets in Africa that actually doesn’t have exchange controls, and the developments there over the last few years are quite interesting.

From June 2021 to date, the Kenyan Shilling has lost value against the US Dollar every single trading week.

What this means is that, if you bought $1,000 with Kenya Shillings in June 2021, you would have paid about KES 107,720. Two years later, in June 2023, that $1,000 would be worth KES 140,520. This represents an annual interest rate of 14.15%, about as high as the yield from government bonds.

What I suspect is driving crypto adoption in Kenya is this economic outlook, and many have turned to USD stablecoins as an easy and convenient way to hedge against devaluation while maintaining the option to easily liquidate to KES on M-PESA using peer-to-peer trades.

And what about CBDCs?

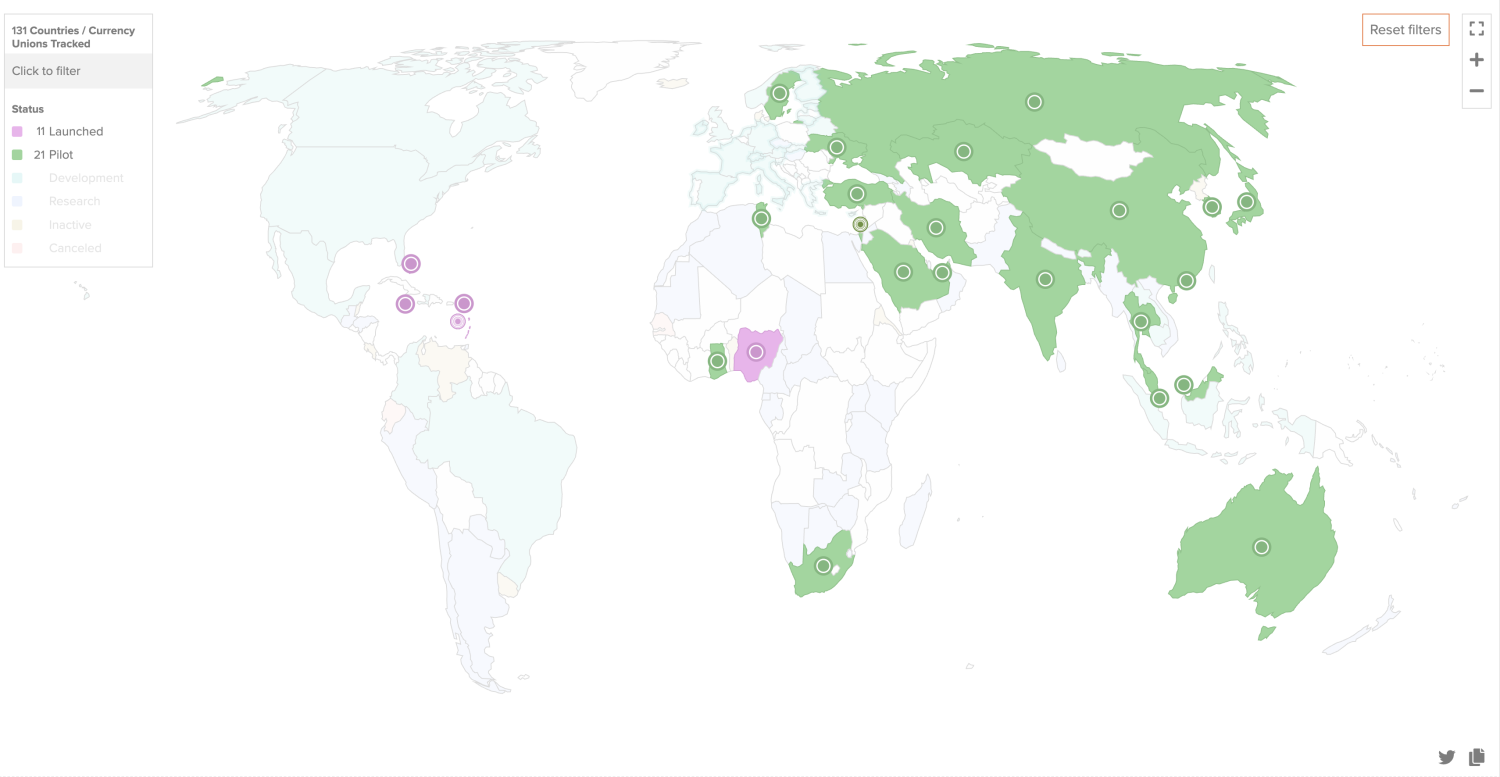

Atlantic Council’s CBDC tracker indicates that there are about 11 deployed Central Bank Digital Currencies globally, and a further 21 being piloted.

Now before we dive deeper, let’s get one basic distinction straight – what sets central bank digital currencies (CBDCs) apart from the crypto scene we’ve explored so far?

CBDCs represent official digital money minted by governments and monetary authorities like the South African Reserve Bank. You can think of them as virtual versions of familiar banknotes and coins, just crafted for the blockchain age. Unlike with Bitcoin or Ethereum though, central banks back these digital tokens with their authority and financial reserves to maintain value, not decentralization alone.

While Bitcoin rolls on market whims, in theory CBDCs offer dependable pegs to actual fiscal policies and assets in ground. But similarly to private stablecoins, tensions bubble between state interests in traceability and control versus user priorities around privacy and censorship-resistance. And implementation complexities abound – even trailblazers like Nigeria and the Bahamas grapple with glitches in pioneering the future of digital fiat.

In essence, CBDCs constitute official digital currencies entering from institutional realms to coexist and compete with independent cryptos in capturing Africa’s increasingly on-chain populations. Their ascent promises intriguing blends between centralized and decentralized payment rails going forward.

But the genie is out of the bottle, friends.

The two countries in Africa that are actively exploring CBDCs beyond the pilot stage are Nigeria and South Africa. Nigeria launched the eNaira in October 2021, but it’s uptake has been abysmal at best. CBDCs work very similarly to stablecoins in that they operate on a blockchain, but so far all the major CBDC projects in Africa have seemingly been implemented on private blockchains, rather than commonly used public ones.

This essentially cripples all of the utility we’ve seen around stablecoins so far, as the CBDCs can’t be transferred on popular chains where there are different assets and liquidity to trade them.

Without this utility, it isn’t clear what benefit CBDCs would introduce to an already vibrant local payments system that exists within each African country.

I have to imagine that the decision to deploy CBDCs only on private blockchains is a very intentional one from the regulators, as deploying them on a public chain would be the equivalent of dismantling the exchange control structures we previously discussed.

Whatever the case, it’s clear that blockchain technology has gained enough relevant traction in Africa to start to be considered an institutional rail. At the same time, the crypto industry is tainted with stories of many disasters that have caused many to lose life-changing sums of money. Without clear and practical regulation that incentivises legitimate entrepreneurs to enter the space, this will never change.

My hope with this piece is to spur continued conversation around common-sense regulation that would encourage market actors to consider Africa as a market, where there is abundant opportunity to solve relevant problems for millions of people.

I hope you enjoyed reading this as much as I enjoyed writing it, and I’m always happy to chat and receive your feedback on Twitter/X or on email via wiza@hey.com Finally, please do consider sharing this article if you found it useful 😄